As we move into 2024, significant changes are coming to Social Security, Supplemental Security Income (SSI), and Social Security Disability Insurance (SSDI) payments. These updates, driven primarily by the Cost-of-Living Adjustment (COLA) and other policy enhancements, aim to provide financial relief to millions of Americans, especially given the economic challenges of recent years.

In this article, we will cover the key changes, how they affect you, and everything you need to know about the new SSA, SSI, and SSDI payment structures for 2024.

2024 COLA Increase: What Does It Mean?

One of the most important updates is the 3.2% COLA increase that takes effect in January 2024. This adjustment will increase monthly payments for more than 71 million Social Security and SSI beneficiaries. The increase is designed to offset inflation and ensure that benefits maintain their purchasing power over time.

Here’s what the COLA increase means for you:

- SSI recipients will see their maximum monthly payment increase from $914 in 2023 to $943 for individuals, and from $1,371 to $1,415 for couples.

- SSDI recipients will see their payments rise accordingly, with the maximum monthly SSDI benefit increasing to $3,822, up from $3,627 in 2023.

These increases will begin with checks disbursed in January 2024 for Social Security and December 2023 for SSI recipients.

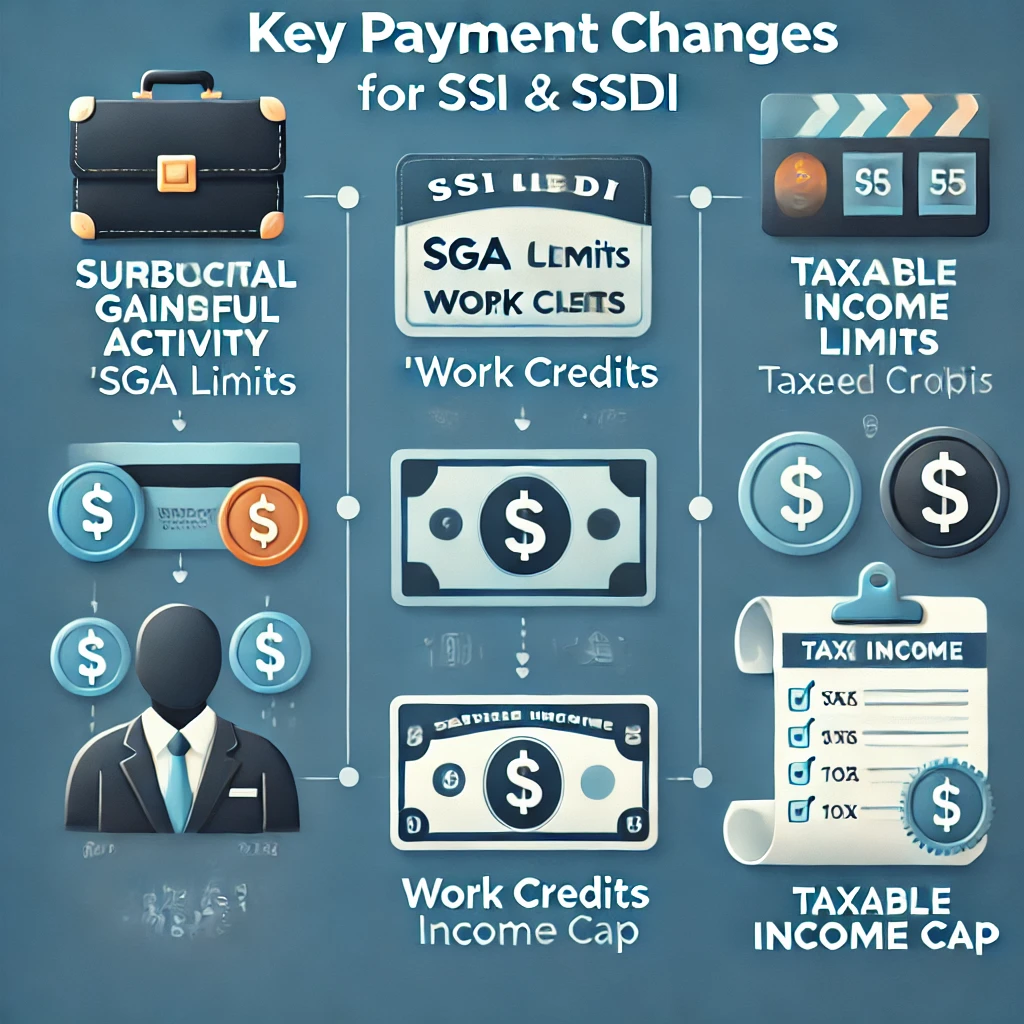

Key Payment Changes for SSI and SSDI

For those receiving SSI or SSDI benefits, several updates will impact your monthly payments and eligibility:

- Substantial Gainful Activity (SGA) Limits: The SGA limits will rise to $1,550 per month for non-blind recipients and $2,590 per month for blind recipients. This means individuals can earn more income without losing their disability benefits.

- Work Credits: To qualify for SSDI benefits, individuals need to earn a certain number of work credits. In 2024, one work credit will require $1,730 of income, meaning you can earn up to four credits annually with earnings of at least $6,920.

- Taxable Income Cap: The maximum taxable earnings subject to Social Security payroll taxes will increase from $160,200 in 2023 to $168,600 in 2024. This means higher earners will contribute more toward Social Security.

Social Security Eligibility Criteria 2024

To qualify for Social Security benefits, you must meet specific eligibility requirements. These include:

- Being a permanent resident of the U.S.

- Having a qualifying disability or blindness.

- Being 65 years of age or older.

- Having limited income and resources.

For those seeking SSDI, applicants need to accumulate sufficient work credits through taxable income.

Key SSA, SSI, and SSDI Changes for 2024

| Program | Change | 2023 | 2024 |

|---|---|---|---|

| COLA Increase | 3.2% increase in payments | N/A | N/A |

| Maximum SSI Payment (Individual) | Standard monthly payment | $914 | $943 |

| Maximum SSI Payment (Couple) | Standard monthly payment | $1,371 | $1,415 |

| Maximum SSDI Payment | Highest monthly payment for SSDI recipients | $3,627 | $3,822 |

| SGA Limit (Non-blind) | Earnings cap to remain eligible for benefits | $1,470 | $1,550 |

| SGA Limit (Blind) | Earnings cap to remain eligible for benefits | $2,460 | $2,590 |

| Taxable Earnings Cap | Maximum earnings subject to payroll tax | $160,200 | $168,600 |

Reasons for These Changes

The COLA increase of 3.2% stems from inflation adjustments calculated through the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The increase is designed to ensure that recipients maintain their purchasing power despite rising living costs.

Other changes, such as the SGA limits and taxable earnings cap, align with the SSA’s goal of adjusting benefits to keep pace with economic conditions and income trends.

Upcoming Changes to Watch in 2024

- Improved Max Monthly Payments: Individuals who retire at 62 will continue to face a reduction in benefits for early retirement. However, those who reach full retirement age will receive a higher monthly payout.

- Expanded Extra Help Program: The Inflation Reduction Act will expand the Medicare Extra Help program in 2024, increasing the number of low-income individuals eligible for assistance with prescription drug costs.

- Higher Work Credit Requirements: For those working and contributing to Social Security, the income required to earn a single work credit will increase. This change is particularly relevant for those close to retirement or disability eligibility.

Conclusion

The 2024 changes to SSA, SSI, and SSDI payments provide important updates for beneficiaries, reflecting adjustments for inflation and economic conditions. With a 3.2% COLA increase, individuals receiving Social Security and disability benefits can expect higher monthly payments starting in January 2024.

Along with these financial adjustments, there are expanded support programs like Extra Help for Medicare, providing additional resources for low-income beneficiaries. Stay informed about your benefits by regularly checking your my Social Security account.

FAQs

1. When will the COLA increase take effect?

The 3.2% COLA increase will take effect in January 2024 for Social Security recipients and December 2023 for SSI recipients.

2. How much will the maximum SSDI payment be in 2024?

The maximum SSDI payment will rise to $3,822 per month, up from $3,627 in 2023.

3. What is the new SGA limit for 2024?

The SGA limit for non-blind individuals will increase to $1,550 per month, and for blind individuals, it will rise to $2,590 per month.

4. Will the SSI eligibility requirements change in 2024?

The basic eligibility requirements for SSI remain the same, but the maximum payment amounts will increase due to the COLA adjustment.

5. How can I check my 2024 Social Security benefit amount?

You can check your 2024 benefit amount by logging into your my Social Security account or by reviewing the mailed letter from the SSA detailing your COLA adjustment.